J. Lyons Fund Management, Inc. Newsletter

| December 2011 |

Posted November 30, 2011 |

| Tweet |

|

The 'Can't Afford Retirement' Plan

Part 2: The essential components of a successful investment plan

“Good fortune is what

happens when opportunity meets with planning.”

-

Thomas Alva Edison

Last month in Part 1 of this series, we discussed the fact that most investors were operating without an adequate plan. We used the seemingly non-stop drip of alternating hope and doom headlines out of Europe and the resulting whiplash in the markets to illustrate the great difficulty in attempting to navigate such volatile markets based on news flow. As if that day-to-day volatility were not enough to make our point, we have now followed up an October that saw the largest monthly gain for U.S stocks since 1987 with a November that, until a last-minute rally, was on track for its largest loss for that month since 1987. To attempt to manage one's investments in such treacherous markets without a plan is akin to sailing without a rudder. The course will be determined by the currents of headlines and the winds of human nature and the ultimate destination will likely be a long way from one's goal.

Sadly, as we stated last month, most investors are indeed operating either without a plan or with one that is fatally flawed. So what constitutes an adequate investment plan? What should such a plan contain? From our experience in managing investments in all types of market conditions over the last half century, we have identified the following components as necessary to any successful long-term investment plan.

If you feel you lack the time, resources or desire to formulate and implement an investment plan and would feel more confident in having a professional manage your investments for you, skip down to the section near the end about selecting a manager.

Components of a Successful Investment Plan

Risk Controls

As we have alluded to many times, the most important component to a successful investment plan is a mechanism to control risk. That we have devoted a disproportionate amount of space to this section is a testament to its importance. Unfortunately this is the area in which most plans are deficient. No plan aimed at generating adequate long-term investment growth can avoid all losses. However, large losses are the biggest threat to an investment portfolio and by simply avoiding those, long-term investment success is possible.

By large losses, we are referring to the 20-50% haircuts associated with cyclical (shorter-term) bear markets. While these kinds of losses are a regular occurrence during all markets, they tend to be closer to the 20% level during secular (long-term) bull markets and closer to the 50% level during secular bear markets (see the 2000-2002 and 2007-2009 market declines). As a reminder about the daunting mathematics involved when incurring large losses:

- A loss of 20% requires a subsequent 25% gain to break even.

- A loss of 30% requires a subsequent 43% gain to break even.

- A loss of 40% requires a subsequent 67% gain to break even.

- A loss of 50% requires a subsequent 100% gain to break even.

As we have stated many times, U.S. stocks remain in the secular bear market that began in 2000. Therefore, losses of the deeper variety will continue to be a risk. One problem is that during a secular bear market, rallies generally only regain approximately what was lost during the preceding decline. Therefore, even if break even levels are reached, further sustainable gains will likely remain elusive. Thus, investors spend most of their time either losing money or trying to recover losses they’ve incurred.

Furthermore, when you combine the significant loss of capital with the psychological damage that large losses can impose, the result can be a complete derailment of one's investment program. Often times, the fear and angst of seeing one's portfolio down 30-50% will cause an investor to capitulate and sell at or near the very low in the market and thus miss out on the subsequent rally.

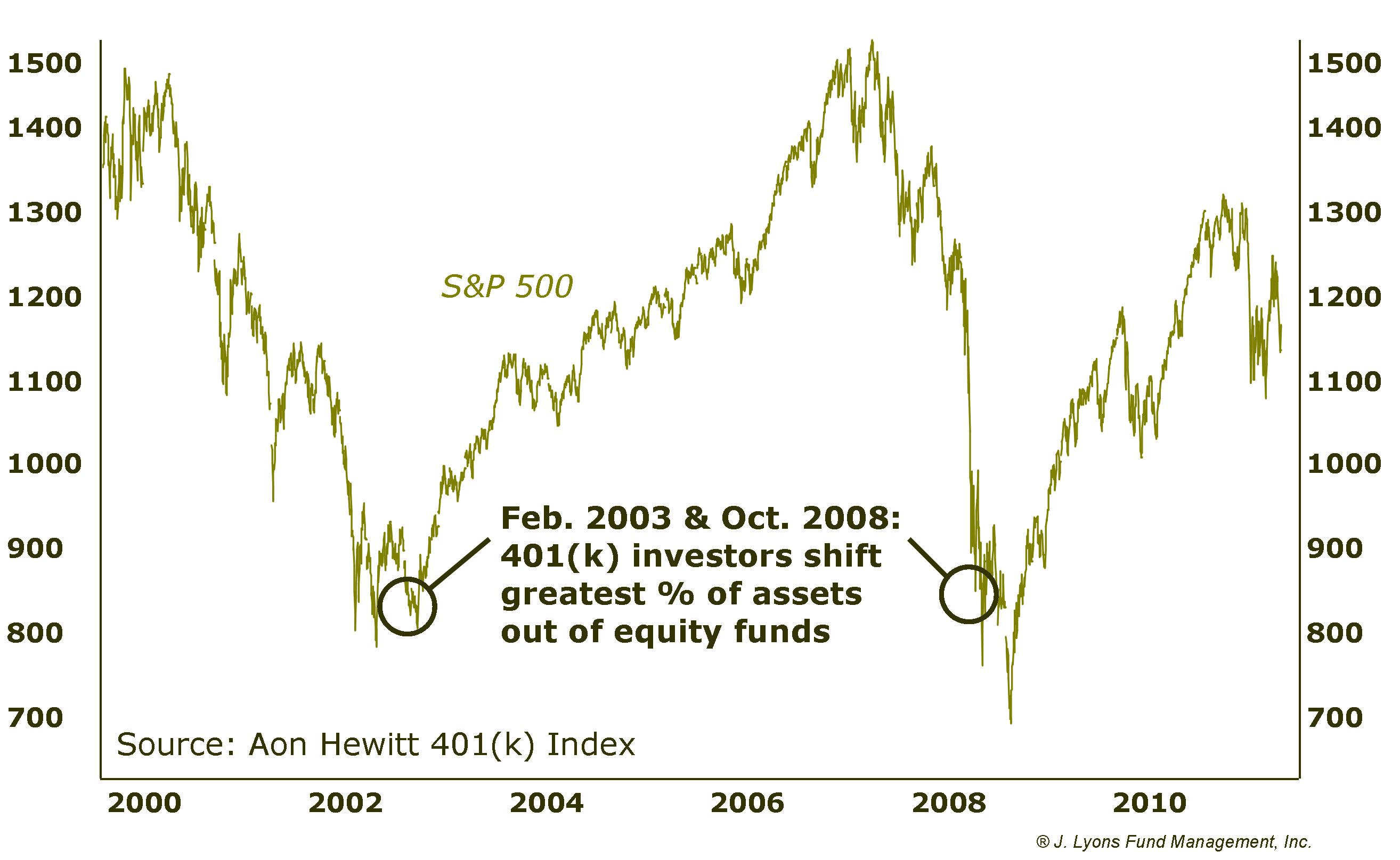

Evidence of this tendency is seen in Aon Hewitt’s 401(k) Index which studies the investment behavior of 401(k) investors. They found that the largest allocation shifts by investors out of stock funds occurred near the lows of the bear markets in 2003 and 2008. If these investors had risk controls in place, they could have taken steps to limit their losses before they got out of hand. They also would not have been subjected to the psychological toll that accompanies such losses and leads to the painful decision to throw in the towel right near the low.

So

what do we mean by risk controls? Any mechanism that triggers action to

avoid losing money is a control on risk. It may be heretical to the

Wall Street establishment but the action that must normally be taken is

to simply sell the investment position. Yes, you can sell your

investments and indeed, the decision to sell is every bit as important

as the buy decision.

How does one decide when to sell to

reduce risk? We use a model comprised of various stock market data to

warn us when market risk is high. Much of the data we monitor are

measurements of market internals, or breadth -- that is, how many

stocks are strongly positioned versus how many are weak. When the

percentage of weak stocks is greater than the percentage of strong

ones,

it is an indication of elevated risk. We also track whether the market

breadth is improving or weakening. Weakening breadth, even if positive,

is a sign of rising risk.

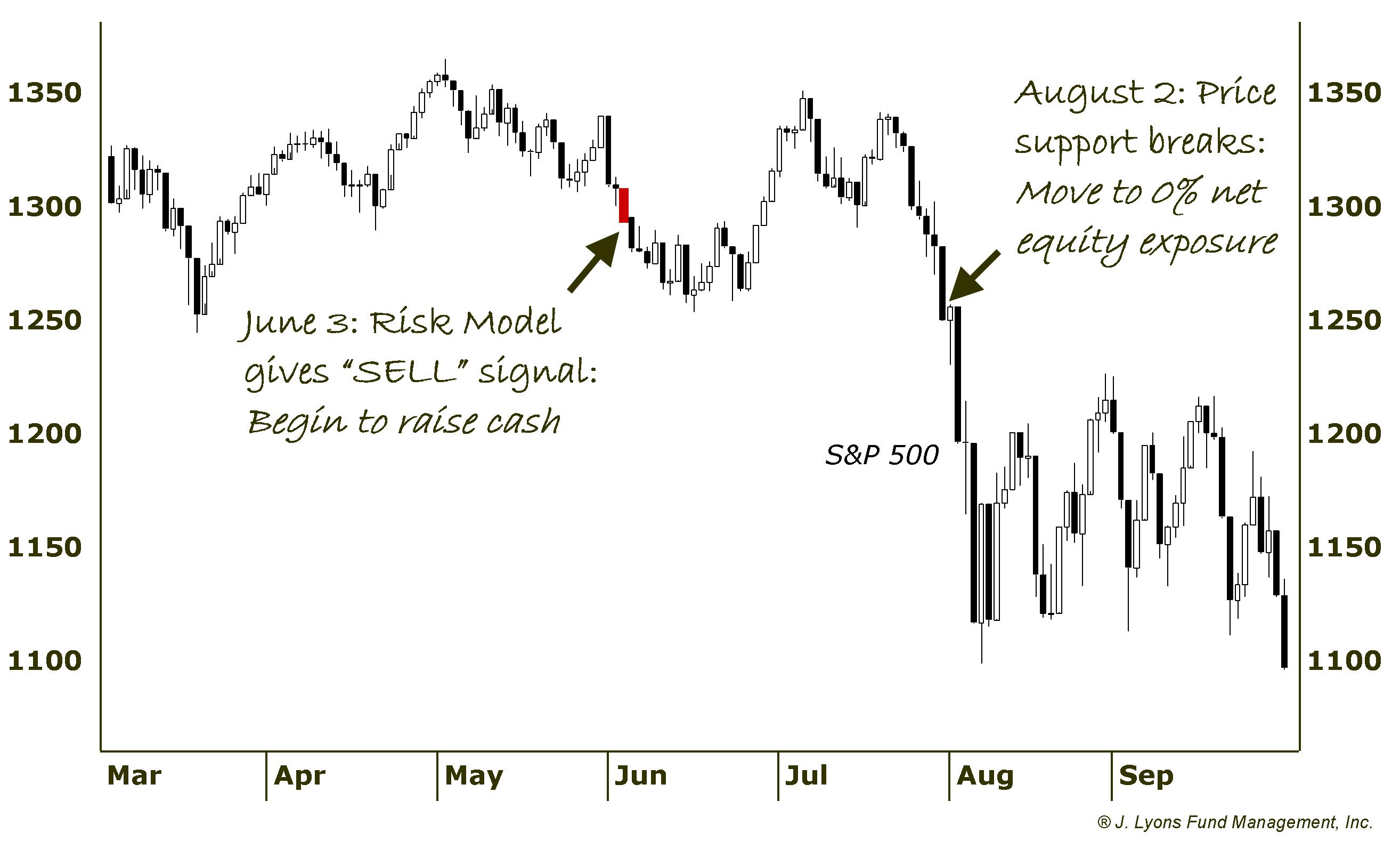

In June of this year, our model

gave a “sell” signal, meaning the data we follow was indicating a high

degree of risk in the market. It does not guarantee the stock market

will immediately decline. However, it indicates a deterioration in the

foundation -- the breadth -- of the market and is a mandate for us to

begin raising cash. It is also a warning that,

should weakness in the market begin to occur, there is heightened risk

that it will lead to significant losses since there are fewer strong

stocks to support the market.

At the end of July, the market

began to sell off sharply, breaking levels of price support. Because of

the warning from our model, we recognized the threat that this was a

prelude to more weakness rather than an immediate buying opportunity.

Therefore, we took decisive defensive action (i.e., we sold long equity

positions and added shorts) in our clients’ accounts to protect against

potential losses. We were able to avoid almost all of the damage

inflicted by the early August crash and spent most of August and

September in a flat or net-short investment position.

While

the risk controls that we utilize are proprietary to our firm, there

are any number of ways to manage risk in one’s investments. Many of the

methods are not even that complicated. Although this would not be our

recommended strategy, on an overall account basis, one could liquidate

their investments should the account suffer a drawdown, or loss, of a

certain percentage. Of course that percentage loss would need to be a

pre-determined figure (hint: it is not -50%) and this strategy would

also necessitate a mechanism for deciding when to reinvest in the

market. While this is a crude method of managing risk, at least it

can be deployed in a way to prevent those large, portfolio-derailing

losses.

Another method of controlling risk that may be

advisable while the current secular bear market runs its course is to

simply reduce one’s exposure to stocks indefinitely. As we’ve stated,

during a secular bear market, stocks tend to move sideways over the

course of many years. If this holds true over the next 6-8 years,

having less equity exposure will not only mean having less risk.

Because of the mathematics of compounding, during a sideways market,

having less exposure to stocks will also result in greater returns than

if one was fully invested (provided the rest of the portfolio is not

tanking). This is yet another example of the importance of controlling

risk.

On specific investment positions, basic moving

averages or stop-loss points can be used to dictate when to sell a

position. This would require the investor to consistently monitor their

investments. These are, however, relatively easy and straightforward

ways to effectively control risk. For investors that are not familiar

with these terms, we certainly invite you to research them. However, if

we may be so blunt, if you are not familiar with these terms you

probably should not be managing your own investments. That is not at

all intended as a slight. Rather, it is the most honest and best advice

we can offer.

Objectivity

Another

requirement of an adequate investment plan is objective input. By

objective, we do not mean “independent” or “unbiased” Wall Street

establishment advice. Although this advice comes under the guise of

being “objective”, it involves some dose of a firm’s or analyst’s

opinion. And by its nature, an opinion is not objective. By

objectivity, we mean cut-and-dry, black-and-white criteria...data,

statistics, prices, etc.

As with the reference to the

European headlines and their effect on the markets, attempting to

invest based on news, opinions, whims or anything else subject to

interpretation is a perilous strategy. It leads most often to an

investment plan based on human natural emotions. The two emotions that

end up dictating investment decisions are fear and greed.

Unfortunately, as illustrated above, fear typically drives investors to

sell near market lows and greed drives them to buy at market tops. This

is a recipe for investment disaster.

Having objective

investing or trading inputs is the best way to overcome the emotions

associated with human nature that push us to make the wrong investment

moves at the wrong time. Whether, it is a piece of market data or a

specific price point on a security that provides clear signals to buy

or sell, objective guidance helps investors to maintain discipline.

This will enable investors to control risk on the downside and take

advantage of opportunities to the upside, even when emotions induced by

the market would normally lead them in the wrong direction.

Having

such objective guidance allowed us to take advantage of the recent low

in the market in early October. Despite the rampant fear and

bearishness present in the market at the end of September, various

indicators that we follow were at levels suggesting that most of the

risk which had been present in late July had been wrung out of the

market. These indicators use purely statistical market data as inputs,

thus they contain no interpretation or bias. They are not subject to

the forces of human nature that we humans are so they can provide clear

direction when the markets get confusing.

Thus when the

stock market was making new lows for the year in early October, our

indicators were telling us that the conditions were in place for a

market low should there be a reversal in price action. Such a reversal

took place on October 4th and our objective indicators guided us in

quickly covering our short positions and quickly adding some longs.

Fortunately, that low held and the rest of October saw a historic rally

(which we hinted at in our October

Newsletter.)

Investment/Trading Rules

Having

objective input is obviously key in establishing investment rules.

Again the clear, unbiased guidance is far more effective as a

decision-making tool than human nature, particularly when the objective

input suggests something contrary to what “feels” right. Once the

decision has been made regarding what objective criteria to use in

guiding one’s investments, the criteria must be organized into a set of

“rules” in order to make effective use of it. The criteria must be

studied and the parameters by which it will dictate buying and selling

must be decided on.

As a basic example, moving averages are

a popular source of trading rules for investors. A moving average is

simply an average of the price of a security over a preceding given

period. When the price of the security is above the moving average, the

moving average will often act as “support”, keeping the price strong

and vice versa when the price is below the moving average. A popular #

of days to include in a moving average is 200 and many investors will

buy a security when it moves above its 200-day moving average and sell

it if it moves below. In theory, this keeps investors “in” during

rallies and “out” during declines.

As mentioned earlier and

described on our site, we use proprietary models comprised of objective

inputs derived from the stock market in order to guide our investment

decision making. We have a Risk Model that indicates when the overall

market is conducive for investing and when it is too risky. This model

gives us unambiguous “buy” and “sell” signals indicating when to be

invested in stocks and when to be out of the market. Period.

Our

Fund Selection Model aids us in deciding what to invest in.

It uses

purely objective price data to rank thousands of investment vehicles to

determine the most attractive investments at a given time.

While there may be more investments marked “attractive” than we can buy

at a given time, we have explicit rules for which investments we can

buy

and also explicit rules for when to sell an investment that is no

longer working.

Are our models and trading rules always

right? Of course not. There is no holy grail. Our models may be

temporarily out of step with the market; however, since the objective

inputs we use come from the market itself, the models cannot stay wrong

for too long. For us, that means avoiding devastating losses during

significant corrections, avoiding investments that are severely

underperforming and achieving decent returns when the market allows for

it and in those areas that are performing the best.

Having

clear investment rules for guidance can mean the difference between a

tough loss and a complete wipeout. For example, this past year, a hedge

fund manager famously and publicly shorted the stock of Netflix on a

thesis that the stock was overvalued. The stock proceeded to move 100

points higher before the manager covered the position, resulting in

large, embarrassing losses for the hedge fund. To make matters worse,

the manager’s thesis was proven correct later in the year as the stock

subsequently dropped over 200 points, well below where he had

originally shorted it. That episode was likely a painful one for the

hedge fund manager, however it was not a fatal one. The manager had

trading rules in place to control his risk by cutting losses once they

reached a certain point. Thus, the fund survived to trade another day.

Consider

another manager, John Corzine, the former head of Goldman Sachs and

former New Jersey Senator and Governor. His most recent position was

the head of MF Global, one of the world’s largest derivatives broker.

Mr. Corzine famously held the philosophy that losses were tolerable as

long as the underlying thesis behind a position was sound. He was

apparently able to get away with this philosophy during his time at

Goldman Sachs, a period which not coincidentally coincided with the

heyday of a secular bull market.

In recent years, as head of

MF Global, Mr. Corzine made investments with the company’s assets into

European sovereign debt instruments. As the debt crisis there began to

unravel and losses mounted, Mr. Corzine apparently held to his

philosophy, believing that his thesis was sound and that he would

eventually be proven right. That scenario never materialized, however,

and his refusal to cut his losses had fatal consequences. MF Global

would become the nation’s 8th largest bankruptcy in history and, most

unfortunately, over 1000 employees would be out of work because of it.

Not to mention, given murky details surrounding activities during MF

Global’s final days, some predict Mr. Corzine will end up in prison.

Often

times, having a set of investment rules can protect us from ourselves.

Although, we may have strong convictions about an investment, it is

helpful to have objective trading rules to tell us when we are wrong,

or at least too early. As the saying famously attributed to economist

John Maynard Keynes goes, “the market can stay irrational longer than

you can stay solvent.”

Discipline

"Unless commitment is made,

there are only promises and hopes; but no plans."

- Peter F. Drucker

Even

after identifying objective criteria and formulating investment rules,

including controls on risk, investors are still only halfway to a

successful investment plan. The last step is to maintain discipline in

implementing the plan. What good is a plan after all if it isn’t

adhered

to? And what good does it do to put the time and effort into

establishing a plan if there is no discipline to follow it?

This

sounds reasonable enough in theory, but in practice, human nature can

wreak havoc on the most sound of investment plans. Even after decades

managing money, human nature exerts its forces on us as well. It takes

a concerted effort to maintain the discipline to follow an investment

plan, in good times and bad. Indeed, discipline has been defined as the

willingness to do what needs to be done, whether it feels right or not.

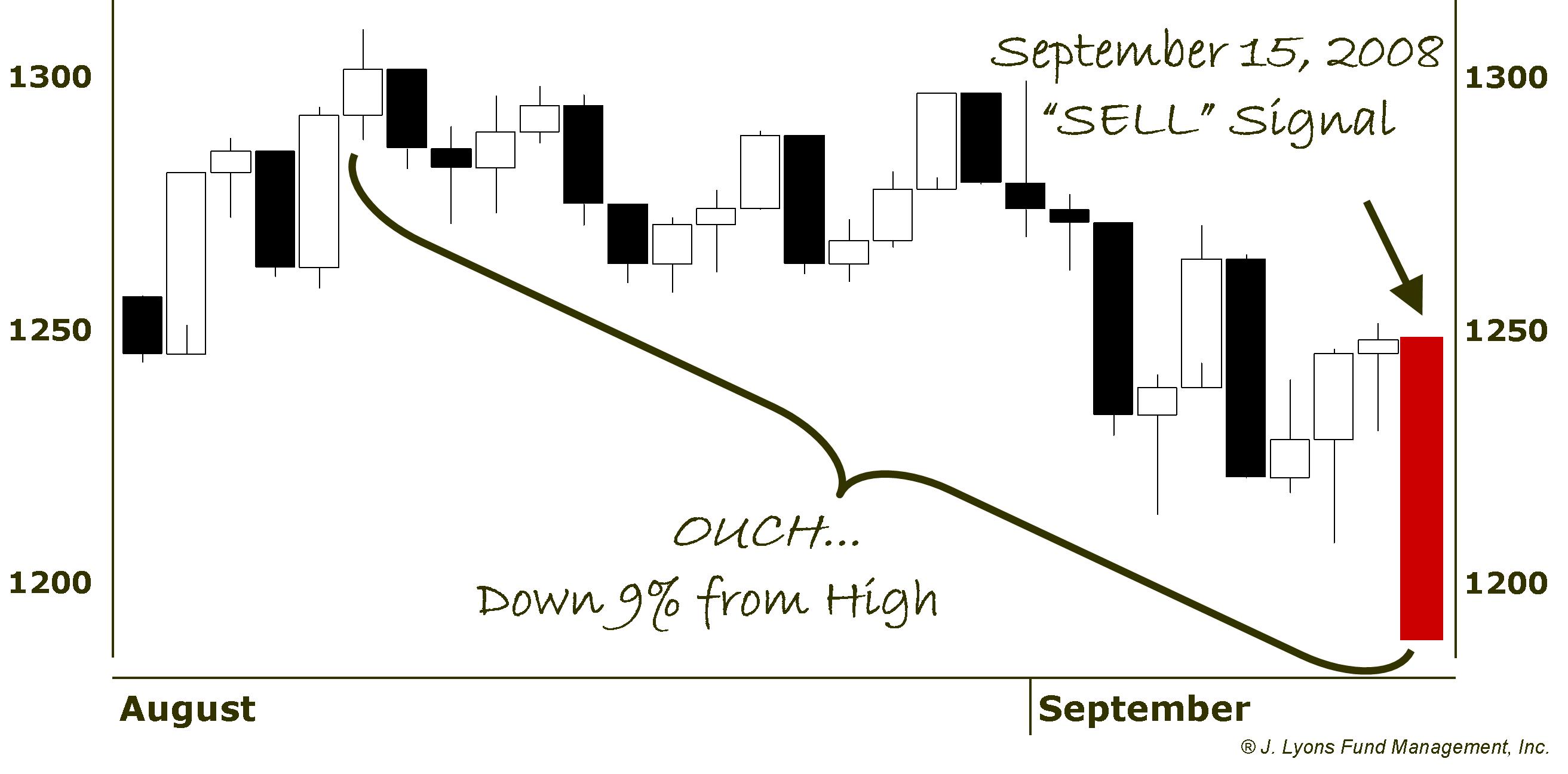

In

early August 2008, our Risk Model gave a buy signal, indicating that it

was appropriate to increase our exposure to stocks, which we did.

Unfortunately, the market almost immediately began to roll over. As our

model takes a fair amount of convincing in order to shift its posture,

it did not immediately switch to a sell. In early September, the market

started to sell off more quickly and it wasn’t until the middle of the

month before our model finally issued a sell signal. By this time, the

market was already 9% off of its August highs. To make matters worse,

the first day we were able to act on our sell signal, September 15, the

market was down roughly 5%. As painful as it was to sell into such

weakness, we maintained our discipline and moved our clients’ accounts

to 100% cash.

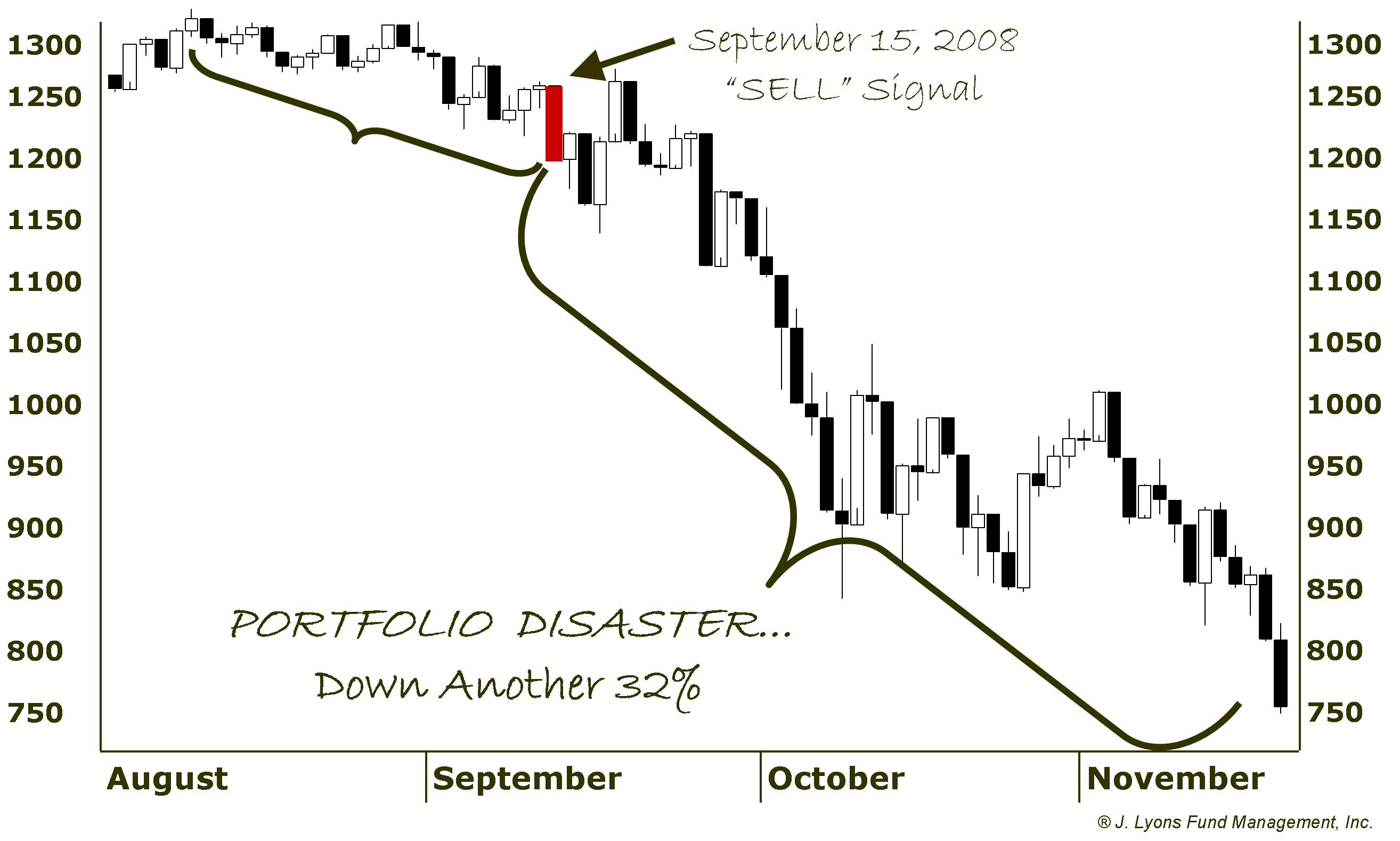

Though selling then was tough to do and it meant taking some losses, it was one of the best moves we’ve ever made. Maintaining the discipline to sell then saved our clients from the massive losses that unfolded almost immediately after. By two months later, the market was down an additional 32%. We took a loss but avoided a disaster.

While

we are patting ourselves on the back, we have also paid the price for

lacking discipline. While the 2003-2007 cyclical bull market unfolded,

we continued to remain cognizant of the fact that stocks were in a

secular bear market environment. Thus, we spent a good portion of the

time underinvested even when our Risk Model was positive. If you have

rules that you are confident in, you must trust and follow them with

discipline and allow them to do the risk management for you.

Even

having the discipline to follow a poor investment plan with risk

controls is better than lacking the discipline to follow a very sound

plan. At least the worst-case scenario can be ruled out. A Netflix

scenario may occur from time to time but never an MF Global. And

even the soundest of investment plans will not be immune to losses. But

taking losses at times if the investment rules dictate it is an

important part of the discipline. It may not feel good at the time

since the urge to feel “right” is a strong force. However, following

the rules and managing risk insures that your money will be there when

the next opportunity comes around, which it always will. As the title

of market researcher Ned Davis’ book implies, it’s not about being

right, it’s about making money.

Access to Assets Besides U.S. Stocks

This component is for investors that have control over the investable assets available to them. Any good investment plan for the rest of this decade should allow for access to investment in assets other than just U.S. stocks. This guideline is not an investment principle but rather a comment on the investment outlook for the foreseeable future.

First and foremost, we are money managers. Part of our job description entails being students and historians of the stock market. And if there is one thing that we are confident about (and have been for the past decade), it's that the U.S. stock market is in a secular bear market and will remain in one for the better part of the remainder of the decade. The ramifications are that, for the next 6-8 years, U.S. stocks will continue to trade like they have over the past 11 years. There will be large rallies up and large declines down, but little or no net progress is likely to be made. Sure, some individual stocks may move to new highs, however the major averages as well as most stocks and stock funds will be unable to make sustainable new highs for several more years to come.

If the U.S. equity market will not afford investors with much profit the rest of the decade, it will need to be achieved elsewhere. With low-risk, real bond yields globally basically at zero, there is likely not much to be gained there. Assets that may be unfamiliar to many casual investors may offer the best chance at investment success. Foreign equities are one potential source, in particular emerging markets.

Emerging markets are countries whose economies are not yet as mature and saturated, investment-wise, as developed countries like the U.S., Western Europe and Japan. Many of these countries are fiscally more sound and growing faster than developed countries and thus make for potentially attractive targets for investment. Most importantly, the investment vehicles that track these emerging markets have decoupled to a degree from the developed nations. Many of their stock markets have been in secular bull markets for the past decade and are therefore less reliant on the economic success of the U.S. and other developed nations to determine their own success.

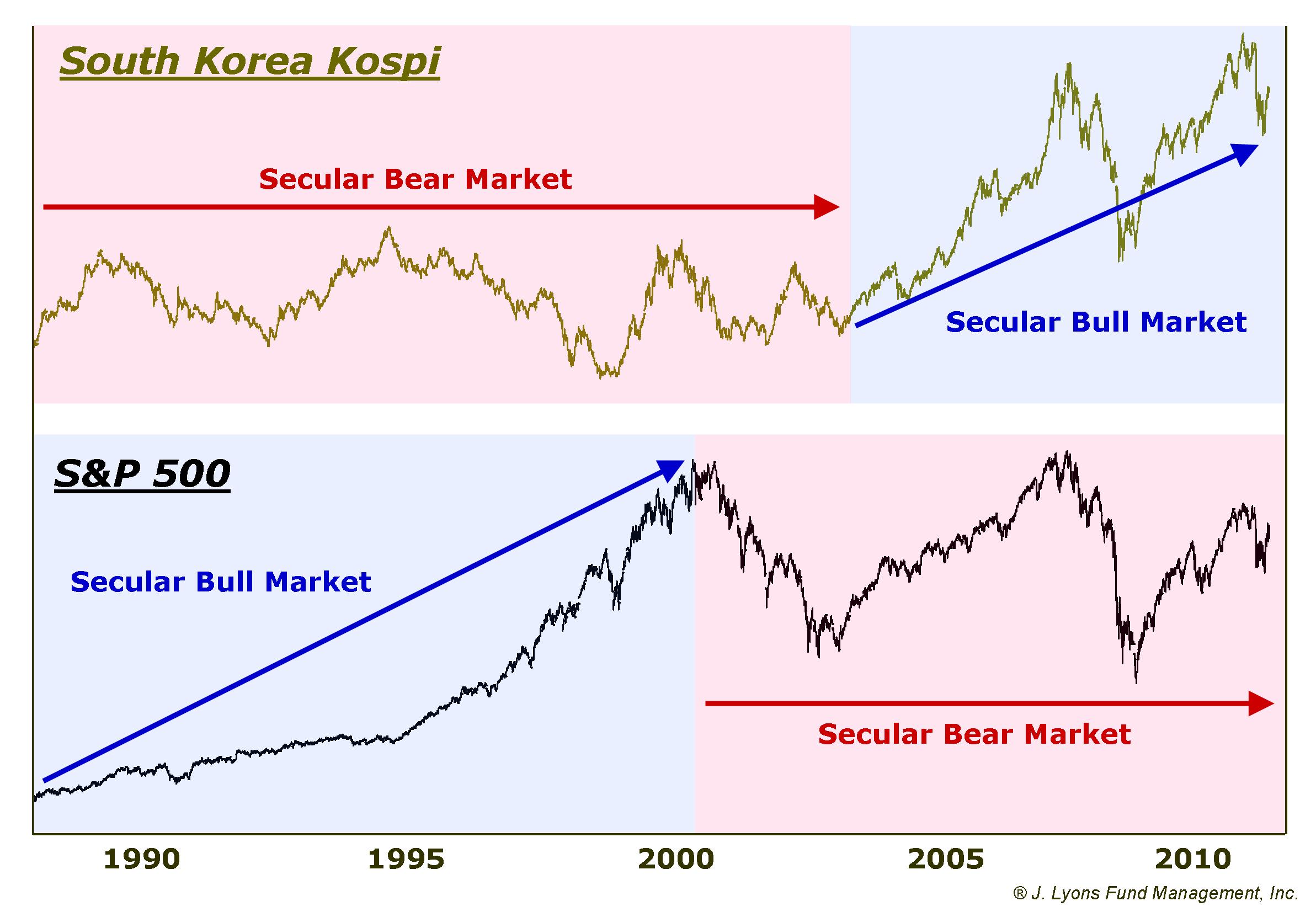

South Korea is just one example:

This is not a recommendation to "buy-and-hold" emerging markets, or anything else for that matter. Like all investments, there is a time to invest in them and a time to avoid them. Additionally, not all emerging markets will perform the same. It will be important to target for investment those that are in secular bull markets and which show the ability to make sustainable new highs.

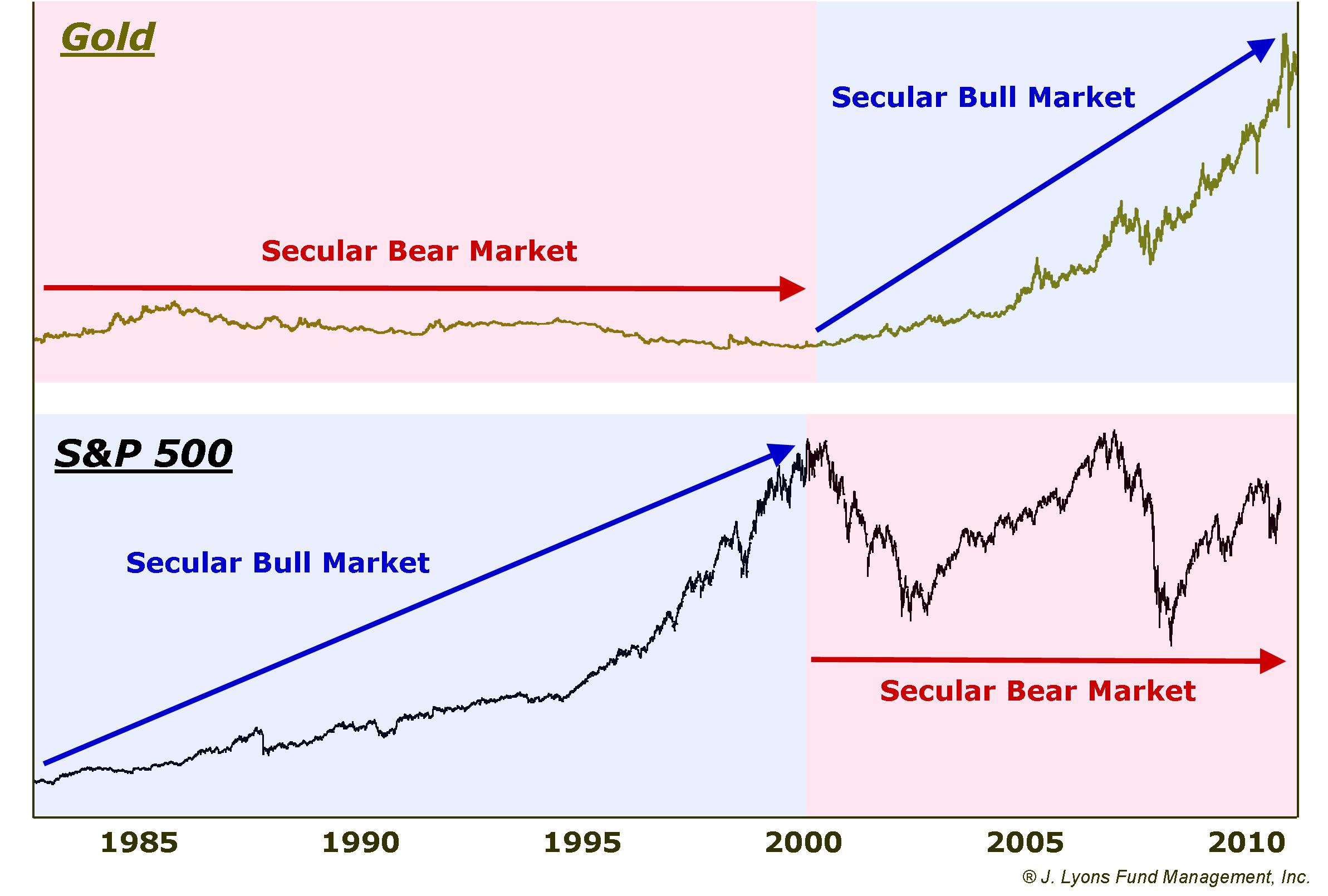

Another asset class that has for the most part been a profitable area for investors the past decade is commodities. These include various hard and soft assets like oil, gold and grains. Like emerging markets, many commodities are in secular bull markets and may provide better potential for profits the rest of the decade. Also like emerging markets, not all commodities are the same. In fact they all behave very differently. Determining those that offer profitable investment potential will take some effort. Again, the best thing to look for in selecting commodities for investment are those that are in secular, or long-term, bull markets.

Gold is just one example:

Alternative assets, if they are available to investors, may offer better opportunity for investors as well the rest of this decade. These include hedge funds, long-short funds, managed futures, etc. These are absolute return products that are less correlated with U.S. stocks and thus less reliant on a bull market in stocks for them to succeed. Like the investment classes mentioned above, not all funds, etc. in these categories are the same. Proper research is necessary to identify those that present the better relative investments.

While we certainly cannot guarantee profitable returns in any of the aforementioned asset classes, we are confident that buying and holding U.S. stocks will not yield meaningful returns over the rest of the decade. Therefore, if one has access to other areas such as those mentioned, at least they will have a chance at success.

Strongly Consider Hiring an Investment Manager

If the thought of putting into place all of the considerations above seems like a daunting task, perhaps hiring a professional investment manager is the best course of action. In fact, it is what we recommend to nearly every investor we speak to. It is not that we are trying to pump up our own business, though we are certainly eager to help investors. It is because we recognize as well as anyone the challenge that the investment task presents. It is a challenge for us and for any honest investment manager, let alone for an individual who already has a full-time occupation to tend to. Becoming an investment expert on their off-hours is not a realistic expectation, despite the fact that 401(k) owners are charged with just such a task. Therefore, we are happy to see any investor retain competent professional investment help, from us or from any other manager.

Unfortunately, the proliferation of 401(k)'s and on-line trading sites has resulted in a push for individuals to manage their own investments and retirement plans. 401(k) owners not only own the plan but they own the responsibility to make it succeed. Just a few decades ago, when defined benefit plans like pensions were the norm, it would have sounded ludicrous to task an employee with the burden of investing their future retirement funds. That job was left in the hands of professional investment managers. Now, the norm is to tell 401(k) participants that they should manage their own investments. As the president of an on-line trading firm states in his commercial, "it's really not that difficult!"

When Congress overhauled the retirement benefit system in this country, the unintended consequence was that individuals, by and large, became responsible for their own retirement investing (imagine that...legislation with unintended consequences.) The legislation basically took the investment professional out of the management of retirement assets. Even the person who set up the very first 401(k) plan (named after the section of code in the legislation establishing the plans) recently stated that the entire 401(k) system should be blown up because it is too complicated for participants.

Professionals are present in every industry and are important because of their expertise and experience. However, the perception of the importance of investment professionals has been largely diminished. This perception, sadly, is due simply to the emergence of self-directed 401(k)'s, which participants largely did not want, and to the fact that an individual can open a trading account without any schooling or licensing and fling money around at will. Unfortunately, it is precisely these groups of investors who have suffered most because of it.

Earlier this year, my wife and I were blessed with our first child. Anyone who has been through that process knows what an awe-inspiring event it is. As the time approached, I remember thinking about the terrifying stories of women giving birth in the car on the way to the hospital. That was the last position I wanted to find myself in. I preferred to have the task of delivering the baby in the hands of the professional. Plus, I don't recall any commercials telling me that delivering a baby "is not that difficult!" Furthermore, not once did I suggest to my wife the possibility of maybe doing it ourselves in order to save money.

That may seem like an extreme example. However, the difference between trying to manage one's own retirement account (and probably winging it) and having a professional manage it can be immense. Consider how much in retirement assets an individual could accumulate over 30 years managing their retirement plan versus how much they would have if they hired a professional. Just an additional 1% per year can mean hundreds of thousands of dollars more at retirement, or several years' worth of retirement income.

For investors who are interested in seeking a professional to manage their investments, our advice is to follow the outline we have laid out above detailing the components of a successful investment plan. Interview any prospective manager to determine their compliance in each of the areas. Specifically:

- Ask for the manager's specific plan for controlling risk and for a track record demonstrating how they have applied those risk controls. For example, ask what their performance was in 2008 during the last bear market. Ask if they are willing to adopt a 100% cash position or at least a net flat equity position in order to control risk during a serious market decline. If they have ever lost more than 20% in a year, move on to someone else.

- Ask the manager what inputs are used in making investment decisions. If they do not identify concrete, objective criteria as opposed to vague, interpretive criteria, move on.

- Ask the manager for their specific investment or trading rules. If they cannot identify specific rules, move on.

- Ask the manager for a track record demonstrating their discipline in the application of their rules. If they cannot demonstrate such a track record, move on. If they state that their strategy has recently changed, ask them to keep you updated as to the performance of the strategy going forward, and move on.

Conclusion

“Let our advance worrying become

advance thinking and planning”

- Winston Churchill

In this 2-part series, we have been honest (some may say brutally so) regarding the investment plans, or lack thereof, on the part of investors, in particular retirement investors. Despite what the Wall Street establishment might describe as a plan, the vast majority of investors are operating without a plan, or with one that is fatally flawed. Typically, the flaw is that they have no mechanism for controlling risk. Such a half-baked plan is inadequate during any period, let alone during a secular bear market. With the bear scheduled to continue for the better part of the remainder of the decade, this "plan" will continue to produce alternating devastating losses and insufficient gains.

Unfortunately, with retirement prospects squarely in the hands of individual investors, the responsibility is on them to make a change in their investment plan. The pathetic, self-serving "buy-and-hold" advice peddled by the investment establishment has failed investors for the past 12 years. That is not a plan and it is time to stop relying on it. Investors are 12 years closer to retirement with nothing to show for that period -- with more of the same to come. It is time to get serious and make a change.

For those with the will to make a change, we have outlined the components that we feel are necessary for a successful long-term investment plan. While necessary, these components are still merely principles. The details and nuances which go into an investment plan are too voluminous for this space, or even most books for that matter. To be honest, we do not expect most readers to attempt to devise such an investment plan. However, if they merely recognize the principles of successful investing that we've laid out here, hopefully they will realize how deficient their current investment plan really is. And if they are sincerely worried enough about the long-term prospects of their investments, hopefully that will spur them to adopt a new plan.

Dana Lyons

Vice President

The commentary included in this newsletter is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.

| Tweet |

|